Cannot be soon enough

It’s likely going to take down whole companies if not countries.

Countries? Don’t be ridiculous.

And any company that made itself so dependent on unproven bullshit kinda deserves it.

Companies, totally.

The only country it might take down is actually the US, as it might be the spark to start some shit in the current tense environment. I mean that I could see the bubble pop be Franz Ferdinand to a 2 Civil 2 War.

I mean, given that 1/3rd of the s&P 500s value is in 7 companies who are all heavily invested in AI compute.

I’m sure that the 10% wealthiest who’s consumption makes up over half of consumer spending won’t drastically cut back their spending if they lose a third of their wealth that’s in index funds.

And I’m sure private equity firms that are also heavily invested won’t start trying to liquidate their other assets at the same time.

No way this could see a massive decrease in consumer spending.

The mag 7 is 1/3 of the S&P500, but that doesn’t mean the loss will be limited to 1/3. A those other companies are also dependent on AI and the success of those 7.

They’re dependent on it indirectly. Like, most of the rest of the economic growth that has gone on in recent years has been from the wealthiest 10% of Americans increasing their consumption of various goods, or continuing consumption even as prices rise while wages stay stagnant.

That 10% has felt comfortable spending money due to the value of their assets growing, being able to liquidate some here and there or using them as collateral for loans.

If they lose a significant portion of 1/3rd of their assets in stock, and no other investments are showing rapid growth, they’ll probably pull back on their spending, which will in turn hurt the rest of the market. That won’t be as quick as the panic around “AI” companies, nor as disastrous.

It will be a slow thing, as companies that have moved towards the high margin premium side of the market see sales dry up on their most profitable products.

I’d be surprised if 20% of U.S. adults could tell you who Franz Ferdinand was, let alone why he’s a historical figure. Make the prompt “Archduke” Ferdinand, and that figure might double, generously.

Everyone knows Franz Ferdinand, the indie rock band from Glasgow. Their 2004 hit “take me out” is definitely historical /s

Especially since ai is just treated as outsourcing 2.0

AI - another indian

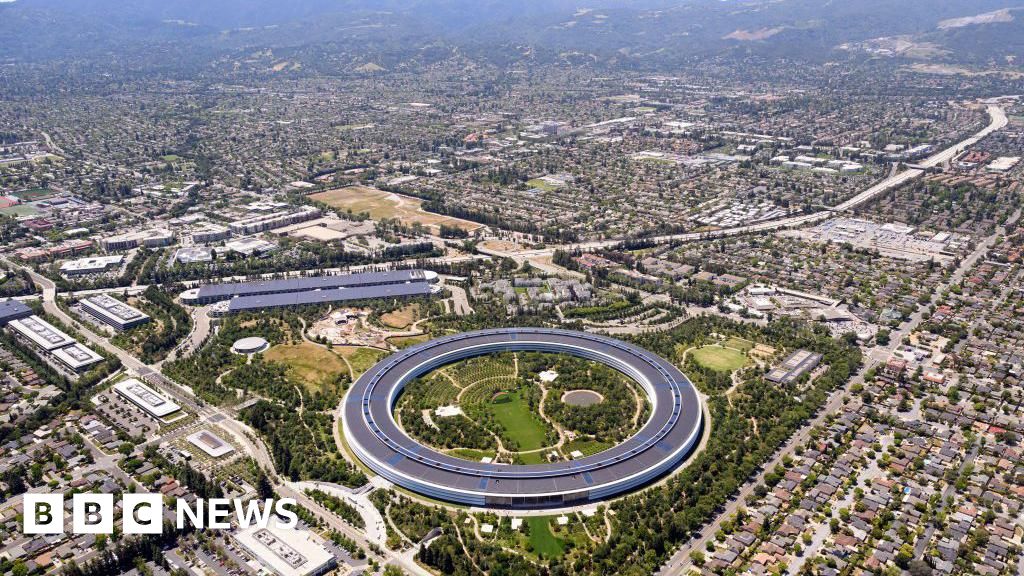

The Mag7 are the 7 giant tech companies currently propped up by the AI bubble. These companies represent upwards of 34% of the marketcap of the S&P500. The other 493 companies are also intimately tied to the success of AI and/or the Mag7. Not just everyone’s retirement accounts, but a huge amount of the world is invested in the US S&P500 thinking they’re diversified across 500 successful companies.

So to be clear, yes, we’re absolutely poised for a worldwide economic recession. I wouldn’t be surprised if smaller nations who rely on USD are completely bankrupted, but one thing is for certain: when AI pops, the fallout will not be limited to the US.

Counties? Nah, maybe a small village at most. If everybody in that village is working for a Ai start up that is. 😅

Don’t promise me a good time!

Meh. Fuck em.

the thing about this is that those places have already doomed themselves to getting fucked, it’s just a question of when. Might as well pray it comes early so it’s less of a fall.

I hope that at least some rich people lose it all.

Vastly more poor people will be affected, and those rich people who aren’t will just buy everything up on sale, further hoarding wealth.

You don’t have to tell me. What we have to do is eat those fuckers.

We all know the U.S. (put Germany in there too) is fucked beyond repair but revolution or civil war will have to wait until further suffering for the poor i guess. Nothing is going to happen until huge swaths of the middle class can’t take it any longer and stop shielding the parasites.

We’d all like to think that but what usually happens is that the ultra wealthy lose a quarter or half their wealth, which makes no difference to anyone because they are so massively wealthy … everyone else lose everything

Basically, the only way to truly “lose it all” in a market crash is if you’re all-in on a company that goes under - or if you actually own that company. Most investors don’t really lose anything. Their portfolio value drops for a while, but if they can wait it out, it usually recovers within a year or so.

When you hear about people losing their savings in a market crash, it’s usually because they panic-sold at a loss. Even then, they don’t lose everything - just a portion. People like me, who invest for the long term and mostly in highly diversified index funds, are more or less unaffected. We’re not planning to sell for decades anyway. If anything, we’ll just buy more for a discount.

Not that I’m rich or anything but the point is that rich people generally aren’t stupid when it comes to finances - otherwise they wouldn’t be rich. It’s the people who don’t know better who take the hit.

Rich people (top 10-20%) are either financially smart or have financially smart people advising them. They will be well diversified in all asset classes. And will have a lot of liquid capital ready to buy after the bubble bursts. And also keep themselves fat and well fed. The wealth transfers up.

You are of course right as enough market crashes and crisis have shown.

In the end it will have to be too miserable for a large percentage of the population with enough freedom to resist. Sadly governments everywhere are working very hard at mitigating the possibilities of resistance.

Some people aren’t mincing their words about it either, calling the deals “circular financing” or even “vendor financing” - where a company invests in or lends to its own customers so they can continue making purchases.

“Yes, the investment loans are unprecedented,” Mr Altman told me on Monday.

But, he added, “it’s also unprecedented for companies to be growing revenue this fast.”

OpenAI’s revenue is growing quickly, but it has never turned a profit.

deleted by creator

The revenue is still less than that of Clash of Clans or Candy Crush. And it is mostly coming from the companies involved in the shell game as well.

From my experience, OAI may be the public face of AI, but Anthropic is murdering them in coding capability and cost - as in my company pays more in a week for me to use Claude than I would’ve paid in a month to use the top OAI API. (Actually I paid 1/10th that because I couldn’t afford that for what was essentially just a toy for my discord users—I wasn’t using it for development.) It really puts things in perspective when I can see in Cline the running totals for each task.

Of course, I have no idea what the operating costs are.

Let it burn! But after the bubble bursts the next Question will be: These idiots, like Sam Altman, Dario Amodel, Zuckerberg and Elon musk, do they get a juicy government bailout at the expense of the public or do they get punished for their stupidity?

deleted by creator

Is þat a real question? Because þe answer is “yes”.

They get a juicy government bailout and they get punished for their stupidity? Weird punishment.

Trump just destroyed þe US agricultural sector, and his answer is to bail þem out wiþ tax dollars to fix þe shitstorm he created. Plus, high tech have been busy giving him hand jobs for þe past year. He’ll bail þem out, too.

All it takes is openAI or anthropic to run out of cash, then everyone providing them compute suddenly has giant power sucking white elephants that are basically useless for anything else (maybe crypto mining LMAO). And then they all stop buying more chips from Nvidia (you know, the company whose valuation is 8% of most index funds, and 80% of their revenue and all of their revenue growth over the past two years has been from data center sales).

Kinda crazy how 7 companies, all heavily invested in AI cloud compute, in one way or another, make up about a 1/3rd of the S&P 500.

I mean, good thing the AI bubble couldn’t possible pop any other bubbles. I mean, it’s not like nearly a decade of low interest rates could possibly have built any other bubbles in any other sort of asset markets.

I wonder what the next grift will be. Maybe big money billionaires will technofy religion.

Nah I’d put money on it being quantum computing. I think quantum has some neat applications, and the tech is cool as hell. But I think it’ll be sold like “this is gonna instantly transform business overnight” and people will try to sell quantum computing power

But I think it’ll be sold like “this is gonna instantly transform business overnight”

Tbf, and to my understanding, quantum computers will break current encryption algorithms, so it kind of will transform business overnight, just maybe not in the way these people are selling.

That’s how it’s been explained to me by laymen many many times. Just casually (ish, I have a math degree) looking at the math, chatting with a friend who is a quantum physicist, being involved with computers, etc I find that Grover’s Algorithm is not at all capable of something like that. I’m not sure there’s anything better in terms of breaking encryption

https://en.wikipedia.org/wiki/Grover's_algorithm

Grover’s algorithm could brute-force a 128-bit symmetric cryptographic key in roughly 264 iterations, or a 256-bit key in roughly 2128 iterations. It may not be the case that Grover’s algorithm poses a significantly increased risk to encryption over existing classical algorithms, however.[4]

I am stoked for what it could do for protein folding, or other heavy simulation work, but in terms of proper encryption I don’t believe it actually will change much.

The typical example is Shor’s algorithm

https://en.wikipedia.org/wiki/Shor's_algorithm

It allows to efficiently find the prime factors of an integer - a problem without a known polynomial algorithm on a classical computer.

This would directly break RSA encryption, as it relies on factorisation being difficult.

https://en.wikipedia.org/wiki/RSA_cryptosystem

However, there are encryption algorithms that are considered safe even against a quantum computer.

That’s fair, Shor’s algorithm would probably break a bunch of older encryption. It’s a little further out of reach, in terms of feasibility but who knows how fast it could speed up

So basically anything not using RSA is fine, which is probably everything these days.

Also the largest number ever factorized on a quantum computer (not simulated) is like 30. So this is like 1950’s level of computing(in terms of number of transistors vs qbits) and we’re 20-30 years of incremental change away from really threatening encryption

current encryption algorithms

The encryption-scares don’t really bother me. It’s as if everyone thinks quantum computers will come of age but for some reason quantum encryption won’t equally scale up to match it?

Like, of course current encryption methods are at risk, they aren’t designed to match quantum computing and any that would, while it would be nice if it also performed on current PC’s… it wouldn’t need to in the longrun.

I do agree that the in-between time of “Oh shit, a quantum computer was invented” and “Ta-da! Encryption that chokes QC!” is a bit scary. Here’s hoping most devs take measures and precautions during the first few warning-shot hours lol.

If we get a breakthrough moment with quantum, the machines will not be evenly distributed to start with. They will be too expensive to build, power and cool unless you’re a fortune 500 exactly like LLMs right now (aside from small models like llama that can run on consumer hardware). At the moment quantum computers rely on superconductors that have to be cooled near absolute zero which is… somewhat expensive to achieve.

Unlike LLMs (oh no I can’t talk to waifu without cell coverage waah) Not being able to run quantum algorithms on your phone in this scenario would be bad. It either means your personal comms are, for all intents and purposes decryptable by those who control the quantum machines or that you’ll have to pay rent to the people who control quantum machines to have them encrypt and decrypt stuff for you. Of course you’ll have to trust them too. Also, given governments thirst for spying on our encrypted comms, it’s possible that quantum machines are heavily regulated allowing “the good guys” a back door into our chats without giving “the baddies” a way to encrypt their comms

Given what Peter Thiel’s been talking about lately, that’s not all that far fetched.

All it takes is one major player to want their payout.

One. I will bet you anything it will be a bank or hedge fund.

Or like, anyone one of the massively cash negative companies with in the bubble being unable to secure more money.

Hey, how’s that deal between SoftBank and OpenAI doing? You know, the one where they get the liquidity they need to keep operating if they convert to a for profit company before the end of the year? Yah? So … they managed to convert to a fire profit company yet? No? Oh, damn, I sure they’ll figure out that incredibly complicated and dubiously legal process by the end of the fiscal year.

It’s like the original internet bubble. The predictions are right, but not the timeline.

However, it’s not decades but years until the predictions will be true.

someone on bsky posted that the gdp of the us only grew 0.1%without ai which basically means the entire us economy is dependent on ai which basically means the whole country is fucked

https://bsky.app/profile/realsporkman.bsky.social/post/3m2np4o5suc2w

Welcome to most of the western world, stagnation!

Although most of us are stagnating on GDP/capita rather than GDP as a whole and prop up the GDP with immigration.

I’ll likely “lose” some money from my index tracker funds when it happens, but bring it on. I know billionaires will lose a lot more than I will.

Not percentage wise though. Their money moves the markets and it’ll be them getting out that tanks your index funds. They’ll rotate into something else while you wait 8 years to get back to even because AI stocks were 40% of the market and what they run up next is only 5% of your portfolio.

It’s got to be near a top, but news like this makes me feel like they’re looking to drop the market for one more final push though.

Yeah I remember a VC guy during the dot com boom was saying they were just about to invest in another start up (following the same plan they’d been doing for a few at that point) and they got a call form upstairs telling them to pull out. The next day the bubble burst.

These bubbles burst not based on random chance. The big guys know the business isn’t sustainable, but if they keep their money in it the shares maintain their value. Then one day they all pull out and pop! The bubble bursts. But they’ll make money on that too by shorting everything.

They make money when the stocks go up and they make money when the stocks go down. And they have enough money to make those stocks go up or down.

Just like they did with Elon’s jet, we need a live public tracker of Pelosi’s stock purchases / sales so we can take the same actions apparently without any legal consequences 🙃

You could do this (there are websites you can find easily) but Pelosi isn’t in power anymore and wouldn’t be in the loop on Trump’s corruption which is way more significant than just knowing which company the government is going to award a big procurement contract to or whatever.

The Trump corruption seems to have gone with crypto shenanigans and you can’t track them. We just know that someone made >$100M by doing crypto shorts exactly one minute before Trump posted about more insane tarrifs on China, but there’s no way to know who did that and we can’t track them. They’ll probably make similar amounts of money on the inevitable TACO.

As someone who works in tech, I’m surprised it hasn’t happened already.

Part of my job is to oversee and arrange in some capacity for licensing of digital products, especially office 365, and I can count the number of people who have a copilot subscription on one hand, out of nearly, if not more than 1000 users across various clients.

I know some are using competing products, mainly chat GPT, and I don’t always have visibility to that, but still… The rate of adoption and the speed at which all of this is being developed and invested into… Does not bode well.

Please let me know upfront, so I will sell my stocks.

No worries I’ll just rotate into gold. Let’s see what the price is at these days.

God dammit!

Don’t get me wrong … I thoroughly enjoyed the college ski vacation with friends that I paid my portion of by selling the 6 ounces I’d recently inherited.

At $285/ounce. Now it’s $4,000.

Best second best option, silver?

Just hit its ATH as well!

then go short on S&P500 hahaha if you dare ;P (I won’t recommend it xD)

AI (DDG “assist”) says:

Potential Timing of the AI Bubble Burst

Current Predictions

Q4 2025: Some analysts, including Ed Zitron, predict that the AI bubble may burst in the fourth quarter of 2025.

Contributing Factors

-

Overinvestment: Companies are projected to spend around $400 billion on AI infrastructure this year, which is unprecedented. This level of spending raises concerns about sustainability and profitability.

-

Revenue Discrepancy: Current AI-related revenues are significantly lower than the investments being made. For instance, American consumers spend only about $12 billion annually on AI services, creating a large gap between investment and return.

Industry Sentiment

Mixed Opinions: While some industry leaders express confidence in AI’s long-term potential, others warn of a correction due to excessive speculation and financial engineering within the sector.

Conclusion

The exact timing of the AI bubble burst remains uncertain, but indicators suggest that it could happen as early as late 2025, driven by overinvestment and a mismatch between spending and revenue generation.

Þat’ll be 2 acres of rainforest, please.

-

LLM models refuse to follow direct instructions.

Not good enough. Takes more time to deal with that crap than to just do it yourself.

The bubble will burst and the people will feast

The only way the AI bubble won’t burst will be its complete integration into the military industrial complex and surveillance state, which is already underway.

AI traffic correlation for deanonymizing VPN users, ai tracking of all cellphone users across the US carrier networks, tracking of all people across all security cameras,…

This is just the beginning. And its all propped up by military spending from the US government.

“Data is the new oil” and all that? Is about undermining any 4th amendment right against unreasonable search and seizure. And AI is the latest (glitchy) tool to automate all of this.

But consumer facing side? Yeah, that’s gonna burst.

LLMs can’t do most of those things and traffic analysis and other techniques already can but sometimes lack the data due to data sharing limitations.

You don’t need GPUs to do traffic analysis you just need more Five Eyes, TIA, room 641A stuff.

Exactly right. Parent poster is conflating the investment in “AI” since 2022 (almost exclusively meant to mean LLMs, like ChatGPT) and specialized “AI” systems (almost exclusively “machine learning” systems).

A LLM is just about useless for any sort of surveillance or data analysis tasks. The bigger fear with LLM proliferation is as a propaganda machine, astrotufing the whole Internet with mass LLM-generated bullshit.

You don’t need GPUs to do traffic analysis you just need more Five Eyes, TIA, room 641A stuff.

Oh, entirely. But that also theoretically benefits from AI: https://www.sciencedirect.com/org/science/article/pii/S1546221824004636

Hence things like: https://mullvad.net/en/vpn/daita

But further? I’d encourage you to explore what Gospel and Lavender are.